5 Key Insights From 2025 Future of Fashion Traceability Report

By Ben Tomkins | 19 November 2025

minutes to read.

The fashion industry is evolving fast and it’s clear from the conversations I have with industry professionals every day that many find it a challenge to keep up.

Regulations are increasing, sourcing is scrutinized, manufacturing is fragmenting, supply chains are disrupted, media are clamoring for headlines…

To better understand the state of the fashion industry and analyze what it will look like in the near future, we partnered with Sourcing Journal on a special Future of Fashion Traceability report.

Drawing on insights from more than 450 fashion industry professionals, our research revealed the true state of cotton and fashion today.

Read on to discover five key insights, the impacts and implications for businesses, and what this means for the future.

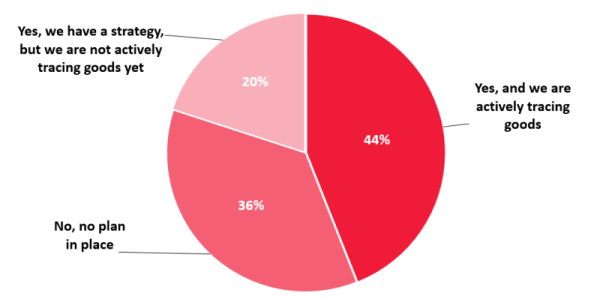

1. Commitment is high, but action is lagging

While nearly 40% of businesses are fully or almost fully committed to end-to-end traceability, more than half (56%) have no traceability plan in place or are not actively tracing goods.

In some ways the challenge in formulating and implementing a traceability strategy is understandable, particularly for SMEs where responsibility may lie with someone from procurement or sustainability who already has a ‘day job’.

The situation with tariffs and economic uncertainty are also potentially leading some businesses to pause their strategy development until the outlook is clearer.

But the longer these companies leave implementing a traceability strategy, the greater and more acute their potential risk becomes down the line.

Cotton will remain a priority trade issue and we can expect to see a rise in UFLPA enforcement. US Customs & Border Protection have invested heavily in isotopic testing capabilities. Tariffs are causing significant shifts in global supply chains. Transshipping and the movement of banned cotton is increasing.

But other evolving regulations are also contributing to the need for effective traceability, including the EU Deforestation Regulation, Transparency in Supply Chains Act, Digital Product Passports, and the potential Buying American Cotton Act.

2. Traceability underpins market success

Nearly two-thirds (63%) believe traceability is a competitive advantage for their business and 61% say traceability will be extremely or very important to their organization’s success in 3-5 years.

Traceability has now become a regulatory and competitive requirement in order to enable trade in an increasingly complex and changing market.

Enhanced reputation is a key competitive advantage for fashion brands and retailers. For brands, it proves your reliability and trustworthiness to key retail channels. Retailers will recognize your brand as a safe pair of hands where there’s little risk of product unavailability due to shipment detentions.

Traceability also supports brands in securing capital, by signaling to potential investors that their processes are robust, secure and compliant, and therefore that they are a safer investment than other brands who lack this level of rigor.

For manufacturers and suppliers, if one of the large retailers they supply goods to sees a negative result through their traceability program, that could put millions of dollars of business at risk. An effective traceability program helps protects their future business and supports their ability to win new tenders.

3. Visibility is rising, but low verification is creating risk

Nearly half of cotton-dominant businesses (46%) have supply chain visibility to tier 4 level, but only 44% always or often verify supplier data.

Having visibility throughout your supply chain, all the way to raw materials at tier 4, is definitely to be commended because full visibility means full transparency and stronger forced labor compliance.

The results shows that almost half of businesses have achieved this, which is likely a result of the impact the UFLPA has had – it’s forced businesses to go beyond the tier 1 visibility that has traditionally been seen as enough.

The fact that the highest percentages in our data are for visibility to tier 1 and tier 4 suggests that companies are either going all-in and introducing full supply chain traceability, or they’re still using just the tier 1 model of the past. As time goes by and we see the regulatory and environmental drivers intensify, I predict we’ll see a significant rise in tier 4 visibility.

But taking supplier data at face value is a risky venture when compliance relies on the accuracy of information provided. If this information is inaccurate, misleading or fraudulent, it can expose brands to significant supply chain risks, brand reputation exposure, and product detentions.

Trust but verify is one of our mantras at Oritain, and forensic origin verification provides a highly precise tool for managing product compliance and traceability.

4. Investment is increasing, but size matters

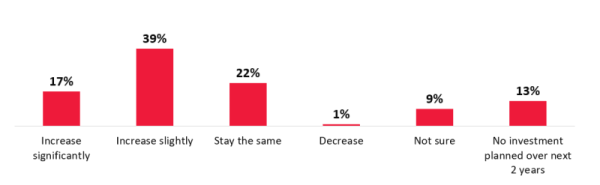

More than half of businesses (51%) increased their traceability investment in the past 2 years, and 56% plan to increase it in the next 2 years – 17% significantly.

In general, the larger the company, the more likely they are to anticipate increased investment in traceability. Companies with more than 250 employees had larger increases over the past 2 years, while companies that employ 5,000+ employees had the highest increases.

It’s a reflection of the maturity of the industry and the importance of those regulatory and competitive drivers that not a single company was decreasing their traceability investment.

This is a reassuring indication that businesses are taking the risks seriously and paints a positive picture of the state of the sector in the near future.

With the scrutiny businesses have today from regulators, consumers, media and other stakeholders, the cost of trading non-compliant or unethical products will be far greater than the cost of a traceability program.

5. Tech and regulation take attention but not investment

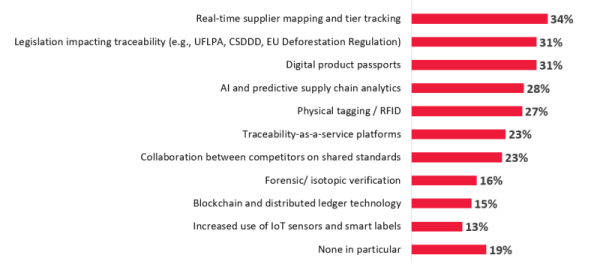

The main innovations businesses are watching are real-time supplier mapping (34%), legislation (31%) and digital product passports (31%), but while half of businesses are watching or researching innovations, only 16% are actively investing in them.

There is a clear ‘wait and see’ attitude being adopted by the industry to many of these emerging innovations, which is understandable given the pace of change today and the setup costs involved in some of the software platforms.

Regulatory-related issues continue to attract a lot of attention, particularly with the EU rolling out digital product passports by industry between 2026 and 2030, and the prospect of other geographies following suit.

Supply chain mapping is a valuable tool in a company’s armory, but it’s important to remember that while this is effective for tracking supplier compliance documents and certification, it doesn’t guarantee physical compliance.

Forensic origin verification provides science-based evidence of product origin through testing and analysis of the product itself. It’s highly resistant to fraud or manipulation, which means businesses can be confident in relying upon it. Oritain’s isotopic testing is an accepted piece of evidence for UFLPA compliance, recognized by DHS and CBP guidance documents.

For the full story, including all the insights and analysis, download The Future of Fashion Traceability report now. If you’re keen to discuss any of the findings and what they mean for your business, contact us to speak with our team.

Disclaimer: The information provided in this document does not and is not intended to constitute legal advice. Instead, all information presented here is for general informational purposes only. Counsel should be consulted with respect to any particular legal situation.