As the latest United States presidential term unfolds, business and community leaders are questioning the role of ESG (Environmental, Social, and Governance) in business.

During the first Trump administration, over 100 environmental regulations were eliminated. Several agencies issued broad guidance discouraging ESG from decision-making. These agencies argued that ESG practices hinder economic growth – despite evidence to the contrary.

Despite the administration’s efforts, ESG-focused funds continued to thrive during the first Trump presidency. Between 2017 and 2020, global ESG assets grew significantly, driven largely by consumer and investor demand.

But in today’s post-election world, ESG is already under the gauntlet in the United States. In this article, we’ll look at some of the issues and what they mean for business.

Government positions challenge business direction

ESG is a polarizing issue in United States politics. Certain states are likely to follow the lead of the federal government in repealing ESG legislation. Other states will take a more active role as ESG defenders. This tension is likely to present a challenge for business leaders.

Certain US government agencies are actively rebuffing ESG initiatives. The US Securities and Exchange Commission (SEC) is expected to abandon its contentious climate disclosure rule. This requires public companies to provide detailed reports on climate-related risks and emissions. Similar disclosure requirements for companies doing business in California are also being challenged.

Outside the US, American businesses operating abroad will still be required to abide by ESG, climate, and sustainability regulations. In the European Union, noncompliance penalties are significant under the Corporate Sustainability Reporting Directive (CSRD).

In the face of this resistance, pro-ESG groups are expected to ramp up their efforts and increase pressure on companies to advance their ESG initiatives. Companies are expected to face mounting pressure from both sides of the ESG debate.

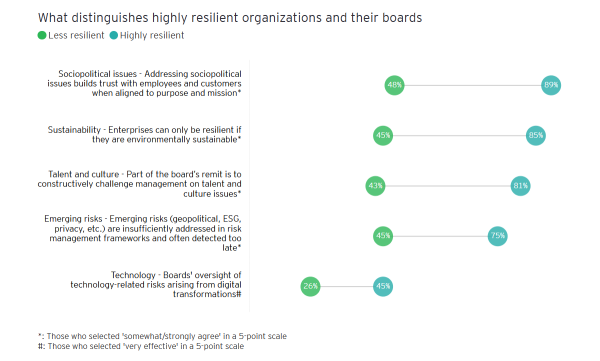

(Source: EY Global Board Risk Survey 2023)

Investors and regulators increase ESG attention

While the US appears to be shifting away from disclosure requirements, it’s a different story in the EU. Environmental regulations requiring companies to manage and report on their supply chains are led by the Corporate Sustainability Due Diligence Directive (CSDDD), the Carbon Border Adjustment Mechanism, and the EU Deforestation Regulation (EUDR).

This focus will keep ESG relevant and a business necessity for many multinational companies. In a 2023 survey of 500 board directors from global organizations with over $1 billion in revenue, two-thirds believe that environmental sustainability is critical for business resiliency.

In addition, investors are likely to increase pressure on companies to disclose more ESG information to cover their bases. Of the 350 global investment decision-makers interviewed in EY’s 2024 Institutional Investor Survey, 88% have increased their use of ESG information.

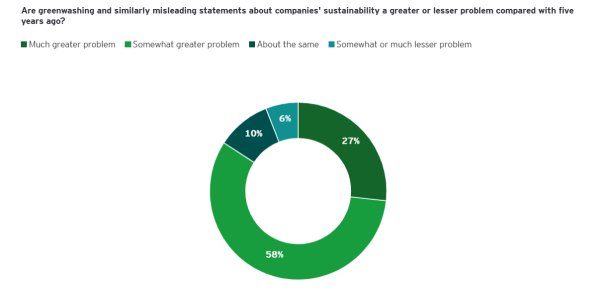

(Source: EY Institutional Investor Survey 2024)

In the same survey, 85% of investors reported thinking that greenwashing is worsening.

An increasing number of countries (including Brazil, Japan, Australia, and Canada) are moving toward mandatory adoption of the International Sustainability Standards Board’s disclosure requirements. Once adopted, US companies operating in those countries will also have to abide by the sustainability reporting requirements.

Adopting a single market approach

Business strategy concerning ESG is clearly complicated when operating across international borders. Practices mandated in one market may be prohibited or heavily restricted in another.

Managing different compliance requirements for different markets is onerous and resource intensive. It requires US companies to add extra monitoring and maintenance to keep different goods separately stocked and not comingled to avoid inadvertent noncompliance.

It’s safer and more cost effective to adopt a single market approach – erring on the side of meeting the most stringent requirements across all markets you operate in.

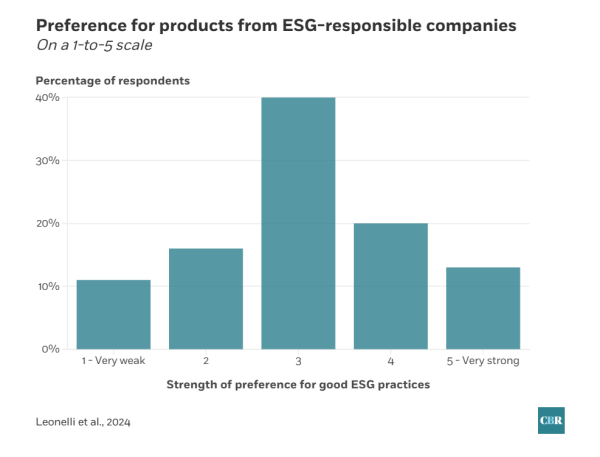

(Source: Chicago Booth consumer survey 2024)

Consumer attitudes favor ESG

The importance of ESG in driving brand preference and consumption remains high – and in some demographics, is rising. Research shows that Gen Z and Millennial consumers are 27% more likely than older generations to purchase a product when they believe the brand cares about its impact on people and the planet.

When they rate a brand highly on transparency, these consumers are 30% more likely than older generations to spend more money with the brand, and 20% more likely to choose it over competitors.

However, when examining consumer attitudes, there can be a marked difference between what consumers say and what they do. One of the reasons for this is a lack of understanding of precisely what a brand’s ESG stance is. In a 2024 study, 35% of participants said they do not have information about brands’ ESG initiatives.

To mitigate this, companies will need to heighten the visibility of their ESG commitments on product packaging, promotional material, online platforms, and other owned channels.

Substantiating ESG claims

To meet ESG and sustainability goals, businesses will need to substantiate the claims they make. Regulators, investors, consumers, and other stakeholders all increasingly expect this.

Proving the origin of products is a key element of this. It assures policymakers and consumers of authenticity. It verifies ethical, responsible, and sustainable production.

Scientific origin verification testing can evaluate whether a product or raw material matches its claimed origin or if it originates from an area of concern. For brands, this is essential in supporting regulatory compliance. The importance of scientific evidence is a common thread of sustainability regulations, such as the use of science in EUDR compliance.

Traditional product traceability relies on documentation and packaging, but this can expose brands to fraudulent practices that threaten compliance. Scientific origin verification analyzes the product itself to mitigate this uncertainty.

In the post-election world, ESG will remain as relevant as ever for United States businesses. While the federal government may be reducing focus on the area, other key markets and audiences are not. Relaxing implementation of corporate sustainability strategies is likely to increase exposure and reduce opportunity.

Oritain is a global leader in origin verification, using market-leading forensic and data science to verify the origin of products and raw materials. We work with leading brands across the world to support their sustainability, compliance, and ESG goals. To learn how we can help your business, speak to our team.

Disclaimer: The information provided in this document does not and is not intended to constitute legal advice. Instead, all information presented here is for general informational purposes only. Counsel should be consulted with respect to any particular legal situation.