Product Traceability: Driving ESG Compliance, Transparency & Sustainable Supply Chains

By Rupert Hodges | 13 March 2025

minutes to read.

The business case for sustainability and ESG has never been clearer. Regulators, consumers and investors are all demanding higher standards from the businesses they engage with and purchase from.

Company executives overwhelmingly view ESG as benefiting reputation, access to capital and competitiveness. A vast majority (84%) say it helps deliver a more robust corporate strategy.

Indeed, 90% of studies reinforce the positive relationship between ESG and company financial performance.

As regulatory pressures continue to escalate worldwide, ineffective supply chain practices pose significant risks, exposing businesses to potential legal and financial penalties.

Meanwhile, stakeholders are demanding companies take greater accountability for their supply chains. They are urging for stronger due diligence measures to minimize environmental impact and foster positive social outcomes.

A large number of ESG-related threats, including forced labor and deforestation, originate in the supply chain. For some organizations, this could be their Achilles heel.

Reaping the benefits – and avoiding the costs – of ESG and sustainability requires businesses to have greater visibility over their supply chains and greater certainty around where their products and raw materials are sourced from.

Regulatory pressures on ESG supply chains

Over the last few years, regulators have been doubling down on social and environmental legislation. Expectations around sustainability reporting have also increased.

The United States has seen the Uyghur Forced Labor Prevention Act (UFLPA) introduced to tackle issues of forced labor compliance. In total, more than ten thousand shipments, worth over three and a half billion US dollars, having been detained.

World Map of Cotton Regulations

In Europe, the EU Ban on Forced Labor is following suit. Regulations like the EU Deforestation Regulation (EUDR) are mandating sustainable practices for businesses in leather, timber, coffee, red meat and other industries.

While the latest “Omnibus” package published by the European Commission proposes to streamline requirements of businesses under the Corporate Sustainability Due Diligence Directive (CS3D) and Corporate Sustainability Reporting Directive (CSRD), businesses will be required to report on their social and environmental impacts.

Growing consumer demand for sustainable products and services has led to greater scrutiny of greenwashing in the EU. Similar requirements to substantiate environmental claims are being introduced in countries like Canada. In Australia, the Australian Competition and Consumer Commission (ACCC) issued strict guidance around environmental claims.

The regulations outlined above emphasize the need for reliable ESG data and reporting on sustainability risks, impacts, and actions. It is the responsibility of brands to demonstrate their commitment to ESG goals, ensuring they mitigate both compliance and reputational risks.

Why ESG and sustainability strengthen business performance

Amidst this backdrop, it’s clear that businesses are now prioritizing ESG and sustainability. In a 2024 global corporate ESG and sustainability survey, the CSRD was the top framework influencing spend for 44% of organizations.

Nearly two-thirds (65%) of the annual revenue of the world’s largest companies are now covered by a net zero target.

Investors are also getting behind this. Supply chain financing programs are incentivizing businesses to improve transparency and sustainability. Those which do receive preferential business terms.

For organizations, this is a win-win. Sustainability and ESG is not just essential for regulatory compliance – it’s also good for business. In a Verdantix report on the business benefits of investing in ESG and sustainability, 91% of businesses named ‘lower risks’ and 82% cited ‘increased revenue’.

Now businesses must meet intent with action. In 2025 and beyond, brand reputation and growth will increasingly depend on transparency and sustainable business. The success of a company’s ESG and sustainability initiatives will depend in large part on the strength of their supply chain.

Challenges in ESG supply chain management

Organizations today are supported by an increasingly complex, global network of suppliers, partners, distributors and retailers.

Sustainable supply chains are integral for compliance with the regulations discussed above. Most of this legislation requires brands to have full oversight of not just their own processes and operations, but also those of all upstream and downstream partners.

And yet, many brands only engage with their Tier 1 suppliers, leaving large parts of their supply chains, especially raw material sourcing, unchecked. This makes it harder for businesses to accurately trace the origin and journey of their products and raw materials – and exposes them to risks hidden in the supplier network.

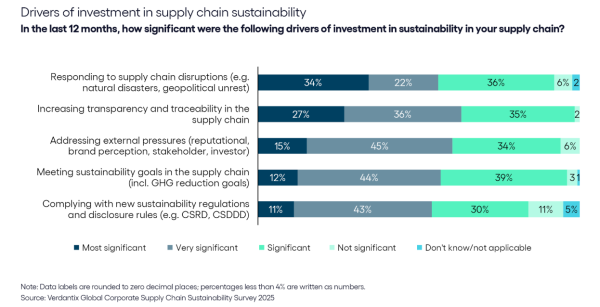

In a 2025 global supply chain survey, increasing transparency and traceability was noted as a key driver of investment for 66% of organizations.

Why is ESG so relevant to supply chain management?

The ESG performance of brands is heavily dependent on that of their suppliers. Unethical, irresponsible or unsustainable sourcing of raw materials is perpetuated throughout the supply chain – ultimately ending up on retail shelves.

Such supply chain risks threaten brands and retailers that believe they’re procuring a compliant commodity, only to discover it’s sourced from a deforested area, produced using forced labor, or doesn’t match what it’s claimed to be.

Managing sustainability performance expands the responsibility of businesses deep into the supply chain. Lack of transparency hinders sustainability.

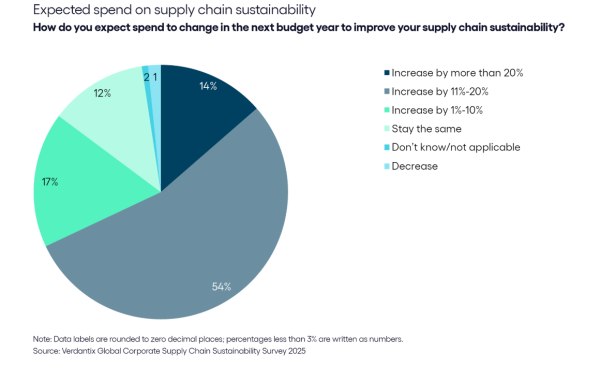

That’s why ESG-powered investment is growing. More than two-thirds of organizations expect to increase their spend on supply chain sustainability by more than 10% in the next year.

But the difficulties of supplier engagement present a challenge to achieving sustainability goals. In the 2025 survey, more than half of companies reported insufficient engagement from suppliers.

More than 40% of brands have already discontinued, or are highly likely to discontinue, a relationship with a supplier due to dissatisfaction with its overall sustainability performance.

~ Verdantix 2025 Global Supply Chain Survey

Clearly there are compelling reasons for both brands and suppliers to improve their supply chain management. The origin of products and raw materials is a key part of the due diligence required – and the stage where many threats arise.

How product origin verification drives ESG success

Proving the origin of products is important for businesses to meet their ESG and sustainability goals.

After all, if brands don’t know where their products originate from, if they can’t prove that the product they’re selling matches what it says on the label, how can policymakers and consumers be sure that it’s authentic? And how can stakeholders be sure that it’s produced ethically, responsibly and sustainably?

Product origin verification supports ESG and sustainability in many ways.

1. Verifying the true source of materials

Sourcing location plays an important role in determining whether the raw materials used in products are likely to be compliant. Regulations discourage sourcing from areas linked to forced labor, deforestation, or other environmental and social issues.

Scientific origin verification testing can evaluate whether a product or material matches its claimed origin or if it originates from an area of concern. For brands, this provides assurance that their products are in line with regulations and less likely to encounter issues with enforcement agencies.

2. Exposing harmful inconsistencies

Products pass through many hands during their manufacture, which creates plentiful opportunities for substitution, blending, or misrepresentation. In industries like cotton and coffee, there is a high risk of substituting non-compliant fiber or beans in place of certified materials.

These practices compromise the integrity of the entire supply chain, making it difficult for brands to trust the final product as 100% compliant. Scientific testing can help identify such inconsistencies and enable them to avoid the risk of costly detainments at the border.

3. Corroborating vendor declarations

Traditional product traceability relies on documentation and packaging. Technology like blockchain can be helpful in collating and managing large volumes of supply chain data.

But these tools are only as reliable as the information entered into them. Relying on unverified self-reported data or digital records from vendors exposes brands to fraudulent practices that threaten compliance. Paper trails alone don’t guarantee authenticity.

Scientific origin verification directly tests the product itself rather than relying on applied tracers or proxy information. By physically analyzing the products themselves, it helps to reduce uncertainty for brands, allowing them to validate their supplier relationships, documentation, and operational processes.

4. Leveraging scientific precision

The importance of scientific evidence is a common thread of sustainability regulations, such as the use of science in EUDR compliance. Therefore, employing science-based product origin verification aligns closely with the spirit and provisions of the legislation.

Oritain traceability technology tests the unique combination of elements in the physical product itself, providing stronger evidence than other traceability tools. Using proven, reliable techniques, it can verify products back to their specific points of origin – in some cases as precisely as to individual farms.

Achieving supply chain sustainability is crucial to deliver on a firm’s ESG and sustainability commitments. Oritain provides essential validation of product origin to help mitigate risks and support supply chain compliance. To learn more, contact us to speak with one of our team.

Disclaimer: The information provided in this document does not and is not intended to constitute legal advice. Instead, all information presented here is for general informational purposes only. Counsel should be consulted with respect to any particular legal situation.