ESG-Powered Investment: Shaping the Future of Supply Chain Due Diligence

By Rupert Hodges | 21 October 2024

minutes to read.

Investment is the lifeblood of most businesses – but leaders today will need to double-down on their company’s sustainability credentials to secure funding from increasingly demanding investors.

ESG (Environmental, Social and Governance) considerations have occupied corporate agendas for many years now, bringing an intensified focus on organizations’ sustainability commitments and environmental impacts.

But the changing expectations of investors, who are increasingly giving financial backing only to those organizations with strong ESG records, is forcing organizations to place even greater emphasis on this.

Why ESG Due Diligence Is Now Essential for Investors and Businesses

In a 2024 study, over 70% of dealmakers globally reported that ESG had become more integral to investment deals in the last 12 to 18 months.

So important has ESG become that nearly 90% of investors incorporate ESG into their investment strategy in some way.

It means that having full oversight of supply chains to ensure sustainable, ethical and responsible practices has never been more critical – for businesses and the investors they rely upon.

Regulatory drivers fueling ESG demand

Legislation has been a key factor in the increased importance of ESG, with regulators asking more of businesses and investors seeking greater reassurances from the companies they partner with.

Over the last few years several governments have started imposing due diligence and reporting requirements related to environmental and human rights issues.

Prominent examples in the EU include the Corporate Sustainability Due Diligence Directive (CSDDD), Corporate Sustainability Reporting Directive (CSRD), EU Deforestation Regulation (EUDR) and EU Forced Labour Ban.

In the US, the Uyghur Forced Labor Prevention Act (UFLPA) has tightened the screws on unethical labor practices for manufacturers and importers, particularly in the cotton and fashion sectors.

More broadly, recommendations made in the OECD Due Diligence Guidance for Responsible Business Conduct formalize the expectations of enterprises in recognizing and minimizing any negative impact from their operations on human rights and the environment.

Markets have repeatedly called for investors to push businesses for greater disclosure about their ESG risks and withdraw their investments if unsatisfied with the response.

As a result, investors are increasingly demanding more stringent ESG due diligence. Incentivized by the financial value of identifying and mitigating ESG risks early, they now expect regular, transparent updates on how companies are addressing risks across their supply chains.

The 2024 study reported that 77% of financial investors say ESG considerations influence their deal strategy and 24% of corporate investors are actively divesting from companies due to inadequate ESG performance.

The risk of greenwashing in ESG reporting

There are compelling reasons for investors to demand greater transparency and accountability from businesses. Investors are motivated by a financial stake in the company to understand the true operational risks and employ effective mitigation processes.

A failure to conduct thorough sustainability due diligence can expose both companies and investors to legal risks, government penalties, reputational damage, decreased sales, and high employee turnover.

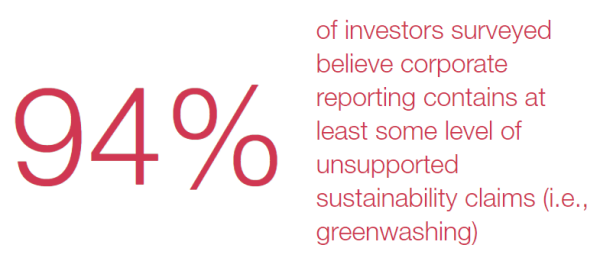

The increase in investment related ESG reporting requirements reflects increased concerns over ‘greenwashing’, or the misrepresentation of ESG achievements for commercial advantage. A large majority of investors (94%) report suspicions that corporate disclosures contain some greenwashing – and this lack of trust is rising.

In 2022, the US Securities and Exchange Commission proposed a climate reporting rule and imposed a record $4.2 billion in fines and penalties for actions such as greenwashing and failure to disclose sustainability risks.

The EU has also actively sought to address the issue with the introduction of regulation aimed at combatting greenwashing and promoting sustainability.

As the push to reduce greenwashing intensifies, companies are expected to prove just how ‘green’ they are, and to explain how ESG considerations or objectives are reflected in their performance.

Growth of ESG investments: performance & scale

Evidence suggests that not only do positive ESG practices reduce the risk of businesses failing to comply with regulatory requirements, but they also positively influence overall business performance.

In 2020, 93% of private equity firms agreed that focusing on ESG generated positive investment opportunities.

Indeed, 90% of studies reinforce the positive relationship between ESG and company financial performance. Naturally this provides an appealing prospect for investors.

The interest in ESG investment has also been bolstered by the fact that many ESG funds have begun to perform as well as their mainstream counterparts. A meta-study of 200 papers and reports found either a positive or neutral correlation between ESG equity funds and conventional indexes.

Today, a total of $8.4 trillion is in sustainable investments, representing 13% of all professionally managed money in the United States.

However, while investors are clearly willing to put their financial weight behind businesses with robust ESG credentials, they are not imprudent with their investments. Businesses seeking this backing must accurately substantiate their sustainability performance – or risk being left in the cold.

Rising expectations for supply chain due diligence

To mitigate the risks and maximize the financial outcomes, investors are now doing greater due diligence around companies’ ESG profiles.

There is much riding on this for businesses. Nearly 60% of US investors cancelled a deal due to findings during the sustainability due diligence process, and 43% of US dealmakers plan to conduct sustainability due diligence in all future deals.

The onus is now on businesses to step up their sustainability reporting and integrate ESG fully into broader corporate decision making. That includes collecting detailed information on environmental impacts, carbon footprints, resource usage, and raw material origin.

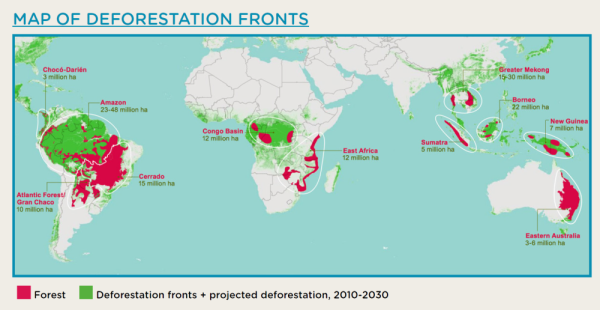

It will also mean expanding the scope of reporting to encompass suppliers, for example cotton growers or coffee producers, whose production methods will impact on the ESG performance of the businesses they sell to.

Brands whose products are found to include cotton originating from growing regions linked to forced labor, or coffee beans from deforested areas, for example, will suffer a critical hit to their ESG credentials – and risk the loss of investor interest.

Enhancing due diligence with traceability solutions

Companies are increasingly employing advanced reporting tools to streamline their processes and improve the credibility of their ESG data.

Scientific verification provides a solution for businesses to prove the origin of their raw materials, thereby strengthening their ESG performance and enhancing their standing in the eyes of investors.

By substantiating that their products are produced responsibly, with minimal impact on the environment, people or resources, businesses can demonstrate a genuine commitment to sustainability.

Oritain is a global leader in product origin verification. Using a pioneering blend of forensic science and data, Oritain helps businesses across the world ensure the authenticity of their products, improve their risk management processes, and meet stringent ESG regulatory requirements.

Greater supply chain traceability allows businesses to have visibility of their products as they progress through stages of manufacture and distribution. However, most traceability tools fail to accurately address the point of origin – one of the most significant influences on environmental impact.

Through Oritain, businesses can provide science-based assurance to investors of their strong sustainability standing – and position themselves to reap the rewards.

(Image credit: Vecteezy)

To learn more about how Oritain can help your organization, contact us to speak with one of our team of experts.

Disclaimer: The information provided in this document does not and is not intended to constitute legal advice. Instead, all information presented here is for general informational purposes only. Counsel should be consulted with respect to any particular legal situation.